15+ Mortgage points

People typically move homes or refinance about every 5 to 7 years. She holds a bachelors degree in journalism with an emphasis in political science from Michigan.

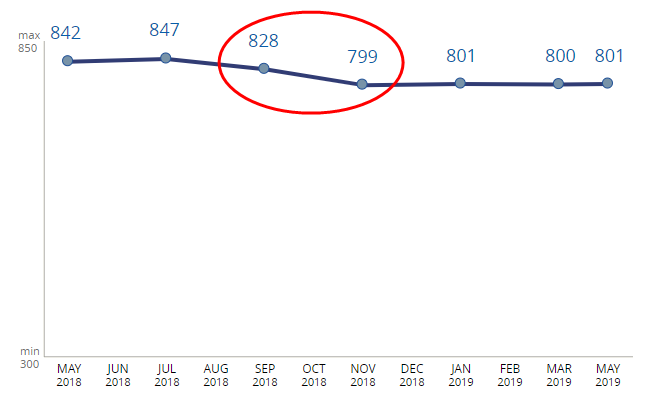

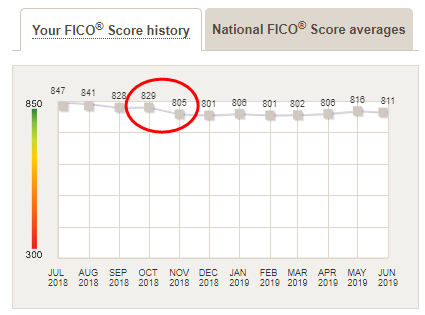

My Credit Score Dropped This Much After I Paid Off My Mortgage

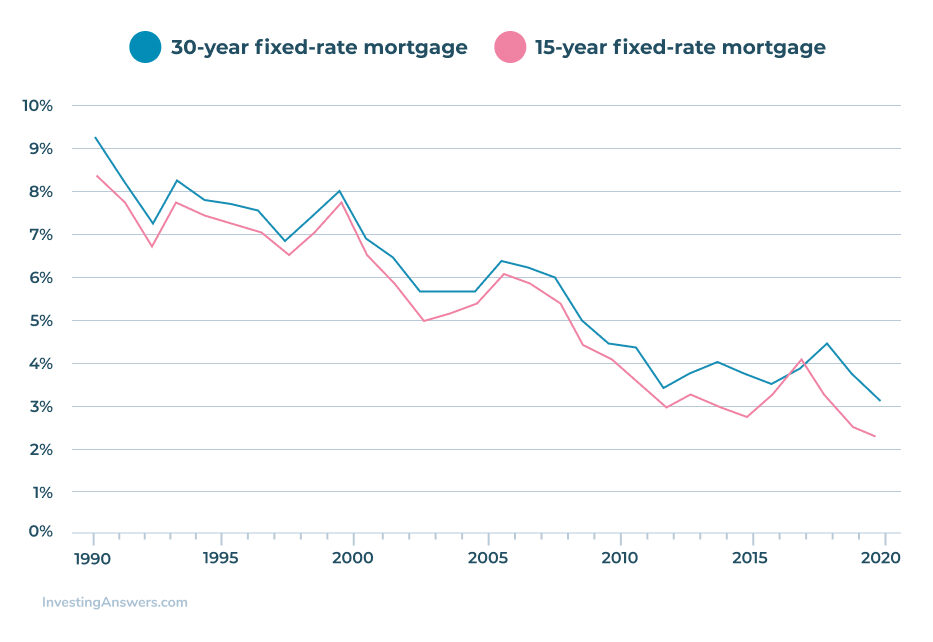

A 15-year fixed-rate mortgage FRM offers a 25 lower interest rate than a 30-year FRM September 24 2021.

. Learn how mortgage points can help you pay less for your home. If a person. The 15-year fixed rate averaged 498 13 basis points higher than last week.

However if points are paid on a home equity loan created after December 15 2017 to improve your home even if you meet tests one through six above. 71 First Time Home Buyer 30 Year. Discount points - a form of pre-paid interest which gives you a lower interest rate for the remainder of the loan.

For example lets say you qualify for a 5. North Middlesex Savings Bank is the premier mortgage lender in Nashoba Valley. Todays national 15-year mortgage rate trends.

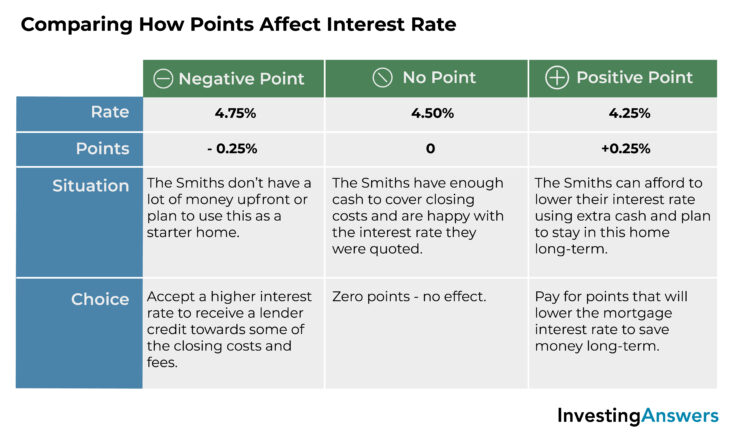

Depending on your mortgage type changes in basis points can impact your monthly mortgage payments. Points are calculated in relation to the size of the loan with each point equal to 1. There are two types of points you can pay on your mortgage loan.

134 million Americans were approved for a single-family mortgage in 2020 a 1126 percent increase from 2018. We are an independent community banking institution providing excellent service since 1885. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan.

15 Year Fixed Rate. If you were to use this option to pay a 2000 mortgage through Plastiq during a 2 promo youd be charged a 40 fee and earn 4080 points. Current Mortgage Rates Data Since 1971.

For today Thursday September 15 2022 the national average 15-year fixed mortgage APR is 5540 up compared to last weeks of 5360. Home Mortgage Center. Todays National Mortgage Rate Averages.

See todays 15-year mortgage rates. Points may also be called loan origination fees maximum loan charges loan discount or discount points. Includes fixed 15-year mortgage rates for conventional FHA and VA loans plus tips to find your best interest rate.

One point equals one percent of the loan amount for example 2 points on a 100000 mortgage would equal 2000. Find weekly and monthly mortgage-rate data from the current week back to 1971 when Freddie Macs Primary Mortgage Market Survey began. Build home equity much faster.

You can buy points when you initially take out a mortgage or when you refinance into a new loan. Homeowners looking to refinance may find 15-year rates the most appealing as theyre. During the loan closing process you can pay for mortgage points to lower the interest rate of your mortgage.

51 Year Adjustable Rate 30 Year Rate. Also known as mortgage points or discount points. What this means.

The average rate for a 15-year fixed mortgage is 551 which is an increase of 18 basis points compared to a week ago. The term points is used to describe certain charges paid to obtain a home mortgage. Start out by making a telephone or in person appointment with our mortgage services to get you moving in the right direction.

The Best 10-Year Mortgage Rates of 2022. National Bureau of Economic Research. NerdWallets mortgage points calculator will help you decide whats best for you.

62 of Americans believe a 20 down payment is necessary though most mortgage loans require less than 5 down payment. Araj is a Section Editor for Rocket Mortgage and held roles in mortgage banking public relations and more in her 15 years with the company. Homeowners looking to refinance may find 15-year rates the most appealing as theyre.

Straight to the Point Valuations. Determining whether you should pay points on your loan. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

Mortgage refinance rates fell today bringing 15- and 10-year rates back under the 5 mark. Origination points - fees that are charged by a mortgage broker or lender for the origination of the loan. Mortgage Center Todays Featured Rates Apply Now Finish Applying View Disclosures Mortgage.

The Mortgage Bankers Association reported a 37 mortgage application decrease from the previous weeks 22-year low. What this means. The Best 15-Year Mortgage Rates for 2022.

Up 16 basis points the flagship average is currently 558. The Federal Reserve recently raised interest rates by another 075. 20 Year Fixed Rate Purchase.

A bank incurs lower costs and deals with fewer risk factors when issuing a 15year mortgage as opposed to a 30year mortgage. 20 Year Fixed Rate. Each point is generally worth 25 of the interest rate.

15 Year Fixed Rate. Rates on 30-year mortgages were back on the move Friday after a brief pause Thursday. Accessed Jun 15 2022.

Education General Dictionary. Mortgage refinance rates fell today bringing 15- and 10-year rates back under the 5 mark. 30 Year Fixed Rate Purchase.

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. As a result a 15year mortgage has a lower.

These points are worth 8160 based on TPGs valuations which peg Membership Rewards points at 2 cents apiece and you could get even more value from them if you transfer them to certain loyalty.

15 Best Online Form Builder Comparison For Lead Generation

My Credit Score Dropped This Much After I Paid Off My Mortgage

50 Mortgage Marketing Ideas To Generate Leads Kaleidico

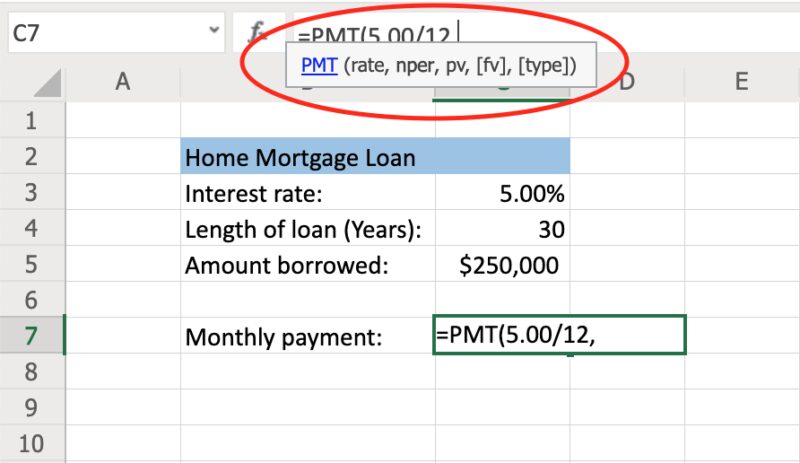

How To Calculate Monthly Loan Payments In Excel Investinganswers

Negative Points Meaning Examples Investinganswers

David Shoffner Mortgage Loan Consultant Preferred Mortgage Services Linkedin

15 Best Online Form Builder Comparison For Lead Generation

.jpg)

Negative Points Meaning Examples Investinganswers

/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

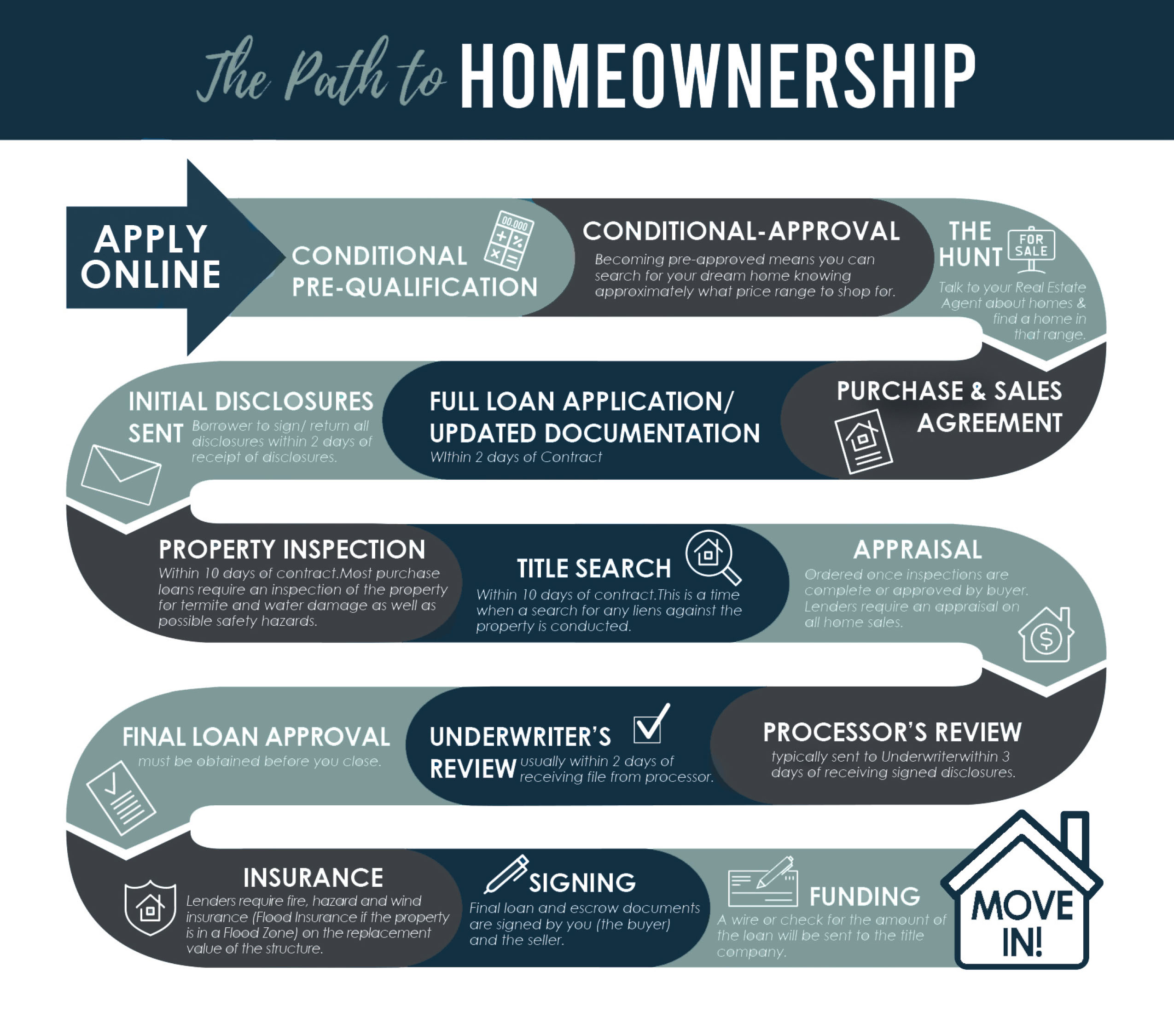

How To Get Pre Approved For A Mortgage

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

Get Pre Approved For A Home Mortgage Financing

How Much Will Cecl Impact Reserves For First Mortgage Portfolios

Historical Mortgage Rates In The Us Averages And Trends

50 Mortgage Marketing Ideas To Generate Leads Kaleidico